China’s hydroxypropyl methyl cellulose (HPMC) industry has undergone remarkable transformation over the decades, evolving from modest beginnings to becoming a global manufacturing powerhouse. For purchasing managers and technical decision-makers in construction, pharmaceuticals, and other industries, understanding this evolution provides valuable context for sourcing decisions. This article traces the development journey of HPMC in China, examining the technological advancements, market dynamics, and quality improvements that have shaped the industry. By exploring this history, we offer insights into why Chinese HPMC has gained significant market share and what factors continue to drive its growth in domestic and international markets.

1. What Are the Origins of HPMC Production in China?

The story of hydroxypropyl methyl cellulose in China begins in the late 1970s, coinciding with the country’s economic reform policies. Prior to this period, China relied heavily on imported HPMC, primarily from Japan, the United States, and European countries.

But here’s what many don’t realize: The first experimental production of HPMC in China occurred in research laboratories at the Shandong Institute of Chemical Technology around 1978. These early efforts were characterized by small-scale batch production with limited output and inconsistent quality.

The first commercial HPMC production facility in China was established in 1982 in Shandong Province, with an initial annual capacity of just 200 tons. This modest beginning marked China’s entry into industrial HPMC manufacturing.

Several key pioneers drove the early development:

- Professor Zhang Mingyu from Tianjin University led research teams that developed modified production processes

- Shandong Tianpu Chemical Co., established in 1985, became one of the first specialized manufacturers

- Shanghai Colorcon Coating Technology Co., a joint venture formed in 1988, introduced advanced quality control methods

| Period | Key Development | Capacidad de producción anual | Nivel de tecnología |

|---|---|---|---|

| 1978-1980 | Laboratory research phase | <50 tons | Basic experimental |

| 1981-1985 | First commercial facility | 200-500 tons | Modified second-generation |

| 1986-1990 | Multiple small producers emerge | 500-1,000 tons | Improved second-generation |

| 1991-1995 | Technology standardization begins | 1,000-3,000 tons | Early third-generation |

The early Chinese HPMC products were primarily low-viscosity grades used in construction applications. Compared to the global timeline, China’s entry into HPMC production came approximately 20 years after its establishment in the United States and Western Europe.

2. How Has Chinese HPMC Manufacturing Technology Progressed?

The technological evolution of HPMC manufacturing in China represents one of the most significant aspects of the industry’s development. From rudimentary beginnings to sophisticated modern processes, this progression has fundamentally transformed production capabilities.

Te sorprenderá saber que that the first major technological breakthrough came in the mid-1990s when several leading Chinese manufacturers adopted modified slurry processes. This transition marked a shift from first-generation to second-generation technology, significantly improving production efficiency and product consistency.

| Technology Generation | Period of Adoption | Características clave | Quality Impact |

|---|---|---|---|

| First Generation | 1980s | Batch alkali cellulose process, organic solvents | Inconsistent quality, high impurities |

| Second Generation | 1990s | Modified slurry process, improved reactors | Better consistency, reduced impurities |

| Third Generation | 2000s | Continuous processing, automated control | Stable quality, specialized grades |

| Fourth Generation | 2010s-Present | Green chemistry, precision engineering | Pharmaceutical-grade, customized properties |

Process innovations that transformed the industry included:

- Development of water-based reaction systems that reduced environmental impact

- Implementation of continuous production lines that increased output while improving consistency

- Introduction of computer-controlled process parameters that enabled precise property control

- Adoption of advanced purification techniques that reduced residual impurities

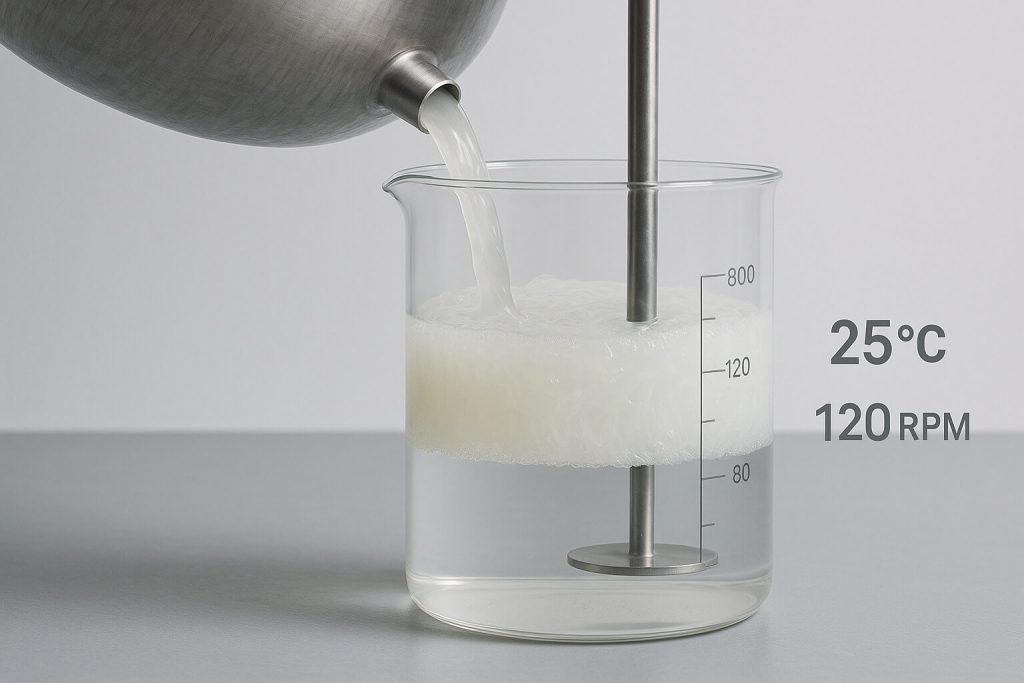

Quality control advancements paralleled these technological improvements. Modern Chinese HPMC facilities now feature fully automated production lines with real-time monitoring systems, advanced process control algorithms, and integrated quality management systems. Production efficiency has increased by over 300% while reducing energy consumption by approximately 40% compared to the processes used in the 1990s.

3. What Market Factors Have Shaped China’s HPMC Industry Growth?

The remarkable expansion of China’s HPMC industry cannot be understood without examining the market forces that propelled its growth. A complex interplay of demand patterns, trade dynamics, and policy influences created the conditions for this industrial success story.

La verdad es que China’s construction boom created an enormous market for HPMC as a key component in dry-mix mortars, tile adhesives, and exterior insulation systems. Annual construction-related HPMC consumption grew from approximately 5,000 tons in 2000 to over 100,000 tons by 2020.

| Period | Domestic Consumption (tons) | Primary Application Sectors | Growth Rate |

|---|---|---|---|

| 1990-2000 | 5,000-15,000 | Construction (80%), Pharmaceuticals (10%), Others (10%) | 12% annually |

| 2001-2010 | 15,000-60,000 | Construction (75%), Pharmaceuticals (15%), Food (5%), Others (5%) | 15% annually |

| 2011-2020 | 60,000-120,000 | Construction (70%), Pharmaceuticals (18%), Food (7%), Others (5%) | 8% annually |

| 2021-Present | >120,000 | Construction (65%), Pharmaceuticals (20%), Food (10%), Others (5%) | 5-6% annually |

Government policies played a crucial role in shaping the industry. The “Go Global” strategy implemented in the early 2000s provided export incentives and financial support for manufacturers seeking international markets. Additionally, environmental regulations introduced after 2010 accelerated industry consolidation, eliminating smaller producers with outdated technology.

Competition dynamics within the Chinese market evolved dramatically. The industry transformed from having over 100 small producers in the 1990s to being dominated by approximately 20 major manufacturers today. This consolidation improved overall quality standards and production efficiency while enabling the remaining companies to invest more heavily in research and development.

4. How Has the Application Scope of Chinese HPMC Expanded?

The evolution of HPMC applications in China reflects both technological advancement and market sophistication. From limited initial uses, Chinese HPMC has found its way into increasingly diverse and demanding applications.

What’s fascinating is how the application landscape has transformed over time. As manufacturing capabilities improved, Chinese producers began developing specialized grades for more demanding applications.

| Sector de aplicación | Initial Period | Estado actual | Key Property Requirements |

|---|---|---|---|

| Construcción | Basic mortars and plasters | Advanced dry-mix formulations, 3D printing materials | Precise viscosity control, workability retention |

| Productos farmacéuticos | Simple tablet binders | Controlled-release matrices, enteric coatings | Ultra-high purity, consistent dissolution profiles |

| Industria alimentaria | Basic thickeners | Texture modifiers, emulsion stabilizers | Food-grade certification, clean label compliance |

| Cuidado personal | Limited use in creams | Complex formulations in cosmetics and toiletries | Sensory properties, compatibility with actives |

| Pinturas y recubrimientos | Basic water-based paints | High-performance architectural coatings | Rheology control, anti-sagging properties |

Research and development of specialized grades has accelerated since 2010. Major Chinese manufacturers now offer product portfolios with dozens of different HPMC specifications, each optimized for specific applications, including:

- Construction-specific grades with controlled water retention and workability properties

- Pharmaceutical grades meeting USP, EP, and JP pharmacopeia standards

- Food-grade products with appropriate regulatory certifications

- Specialized grades for ceramic extrusion and 3D printing applications

The current application distribution shows construction still dominating with approximately 65% of volume, but pharmaceutical applications now represent about 20% of consumption and generate a disproportionately higher share of revenue due to higher unit prices.

5. What Challenges Has the Chinese HPMC Industry Overcome?

The path to industry leadership was not without significant obstacles. Chinese HPMC manufacturers faced and overcame numerous challenges that shaped the industry’s development trajectory.

La realidad es many early producers relied on imported cellulose, creating cost disadvantages and supply uncertainties.

| Challenge Category | Specific Issues | Solutions Implemented | Time Period |

|---|---|---|---|

| Materias primas | Limited high-quality cellulose supply | Development of domestic sources, improved purification | 1990s-2000s |

| Technical Production | Inconsistent reaction control, impurity issues | Process engineering improvements, equipment upgrades | 1990s-2010s |

| Consistencia de calidad | Batch-to-batch variation, specification control | Automated monitoring, statistical process control | 2000s-2010s |

| Aceptación del mercado | Skepticism about Chinese quality | International certifications, customer partnerships | 2000s-2015 |

| Environmental | High solvent usage, wastewater issues | Green chemistry adoption, closed-loop systems | 2010s-Present |

Technical production difficulties were particularly challenging during the industry’s early years. The complex etherification reactions required precise control of multiple parameters including temperature, reaction time, and reagent concentrations. Many early producers struggled with inconsistent results and low yields.

Market acceptance hurdles were substantial, particularly in international markets. Chinese HPMC initially faced skepticism regarding quality and reliability. Overcoming this perception required years of consistent quality improvement, international certifications, and relationship building with key customers.

The industry’s response to these challenges demonstrates remarkable resilience and adaptability. Industry estimates suggest that leading Chinese HPMC manufacturers invested between 5-8% of annual revenue in research and development during the 2010s, significantly higher than the 2-3% typical in the 1990s.

6. How Does Chinese HPMC Compare Globally Today?

The current position of Chinese HPMC in the global market represents a dramatic evolution from its humble beginnings. A comprehensive comparison reveals both strengths and continuing challenges.

What’s truly remarkable is that China now accounts for approximately 60% of global HPMC production capacity, a complete reversal from the 1990s when Chinese production represented less than 5% of the global total.

| Región | Production Capacity (2023) | Cuota de mercado | Growth Trend |

|---|---|---|---|

| Porcelana | ~400,000 tons | ~60% | Steady growth |

| Europa | ~120,000 tons | ~18% | Stable |

| América del norte | ~80,000 tons | ~12% | Slight decline |

| Japón | ~40,000 tons | ~6% | Stable |

| Others | ~30,000 tons | ~4% | Moderate growth |

Quality standards and certification achievements demonstrate significant progress. Leading Chinese manufacturers now hold multiple international certifications including ISO 9001, ISO 14001, pharmaceutical GMP approvals, and food-grade certifications.

Price competitiveness remains a significant advantage for Chinese producers. Manufacturing costs in China typically run 15-25% lower than in Western countries, primarily due to economies of scale, vertical integration, and process efficiency improvements.

Market share in global HPMC trade has shifted dramatically. China has transformed from being a net importer to the world’s largest exporter of HPMC. Chinese exports now reach over 100 countries, with particularly strong positions in Asia, Africa, and parts of Europe.

Research capabilities have developed substantially, with several Chinese manufacturers now operating sophisticated R&D centers and publishing in international scientific journals. Patent activity by Chinese HPMC producers has increased dramatically, with over 500 patents filed in the past decade compared to fewer than 50 in the 1990s.

7. What Does the Future Hold for China’s HPMC Industry?

The trajectory of China’s HPMC industry points toward continued evolution, with several clear trends and developments on the horizon.

The big question on everyone’s mind is whether Chinese manufacturers can continue their upward quality trajectory to compete in the most demanding application segments.

| Future Aspect | Projected Development | Timeline | Impact Factors |

|---|---|---|---|

| Capacidad de producción | Moderate growth to ~500,000 tons | By 2030 | Market demand, consolidation |

| Technology Focus | Bio-based production methods | 2025-2035 | Sustainability demands, regulation |

| Market Positioning | Increased high-end market penetration | Ongoing | R&D investment, quality perception |

| Sostenibilidad | Carbon footprint reduction by 30-40% | By 2030 | Regulatory pressure, market demands |

| Industry Structure | Further consolidation to 10-15 major players | By 2028 | Competition, capital requirements |

Research focus areas are increasingly centered on sustainability and advanced functionality. Major Chinese manufacturers are investing in:

- Bio-based production methods using renewable resources

- Reduced environmental impact through solvent-free processes

- Novel HPMC derivatives with enhanced performance characteristics

- Application-specific grades with optimized property profiles

Market growth projections remain positive but more moderate than in previous decades. Industry analysts forecast annual growth rates of 4-6% for the next decade, with higher rates in pharmaceutical and food applications (7-9%) and more modest growth in construction applications (3-4%).

The most successful companies will likely be those that balance continued cost competitiveness with increased innovation and sustainability, while addressing lingering quality perception issues through consistent excellence and transparent communication.

Conclusión

The development history of hydroxypropyl methyl cellulose in China represents a remarkable industrial evolution. From modest beginnings in the late 1970s with rudimentary technology and limited production capacity, the industry has transformed into a global manufacturing powerhouse that now accounts for the majority of world HPMC production.

This transformation was driven by a combination of factors: technological advancement that closed the gap with Western producers, market dynamics that created both domestic and export opportunities, and the industry’s ability to overcome significant challenges in raw material supply, quality consistency, and environmental impact.

Today, Chinese HPMC manufacturers offer a comprehensive range of products serving diverse applications from construction to pharmaceuticals, with quality levels that increasingly meet international standards. The industry has evolved from being primarily cost-competitive to offering genuine value through specialized products, technical service, and reliable supply.

For purchasing managers and technical decision-makers evaluating HPMC suppliers, this historical context provides valuable perspective. As the industry looks toward the future, sustainability initiatives, further specialization, and continued quality improvements will likely define its next chapter.

Sección de preguntas frecuentes

Q1: When did commercial HPMC production begin in China?

Commercial HPMC production in China began in 1982 with the establishment of the first manufacturing facility in Shandong Province. This initial production was small-scale, with an annual capacity of approximately 200 tons, and focused primarily on basic grades for construction applications. The industry remained relatively small throughout the 1980s, with significant expansion beginning in the 1990s as technology improved and domestic demand increased.

Q2: What are the main applications of HPMC manufactured in China?

HPMC manufactured in China is used across multiple industries, with construction remaining the largest application sector, accounting for approximately 65% of consumption. Pharmaceutical applications represent about 20% of consumption, where HPMC functions as a tablet binder, film-coating material, and controlled-release matrix. Food applications account for approximately 10%, using HPMC as a thickener, stabilizer, and emulsifier. Other applications include personal care products, paints, ceramics, and various industrial processes.

Q3: How has the quality of Chinese HPMC changed over the years?

The quality of Chinese HPMC has improved dramatically since the industry’s beginnings. Early products (1980s-1990s) were characterized by inconsistent properties, high impurity levels, and limited grade options. Through significant investments in manufacturing technology, quality control systems, and research capabilities, leading Chinese manufacturers now produce HPMC meeting international standards including pharmaceutical pharmacopeias. While quality varies among manufacturers, top-tier Chinese producers now compete effectively with Western and Japanese suppliers in most application segments.

Q4: Which regions in China are known for HPMC production?

HPMC production in China is concentrated in several key regions. Shandong Province remains the largest production center, accounting for approximately 40% of national capacity, with major manufacturing clusters around Weifang and Zibo. Hebei Province ranks second with about 20% of capacity, particularly around Shijiazhuang. Other significant production regions include Jiangsu Province, Anhui Province, and Guangdong Province. Recent years have seen some production shifting to western provinces such as Sichuan and Shaanxi as manufacturers seek lower operating costs.

Q5: How does Chinese HPMC pricing compare to international markets?

Chinese HPMC typically offers a price advantage compared to Western and Japanese alternatives, with differences varying by grade and application. For standard construction grades, Chinese products are generally 15-25% lower in price than Western equivalents. For pharmaceutical and food grades, the price differential narrows to 10-15% as quality requirements increase. This pricing advantage stems from several factors: lower manufacturing costs due to economies of scale, vertical integration advantages, process efficiency improvements, and strategic pricing to gain market share.